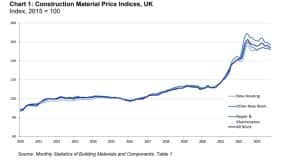

Undeniably, the last few years have been tough on the construction industry. COVID, the War in Ukraine and the wider cost-of-living crisis have all significantly contributed to rising material costs. Property developers large and small across the UK and the South East have felt the knock-on effects.

While inflation is showing early signs of slowing down, and economies around the world are beginning to recover, the industry is still facing a decline in demand and high mortgage rates. So, what will happen to building material costs in 2024? In this blog post, we will explore what to expect in the next 12 -18 months, and what that might mean for you and your developments.

Will Construction Costs Fall in 2024 and 2025?

The short answer is… it looks like they will. Insight DIY says that “2023 saw the first signs of a fall in the cost of metals. A decrease in demand has seen the forecasted price deflation come to fruition, meanwhile, the ongoing unsteady economic situation in the UK has solidified this.” Paul McFadyen, Chairman at metals4U, argues that with disruptions to supply chains and increased post-pandemic demand, a more reliable supply of raw materials should drive prices down.

“We’ve already seen green shoots in the cost of materials. The period between June and August 2023 saw an average drop of 1.6% in the cost of raw materials compared to the previous year, and this trend looks likely to continue into 2024. Before this drop in June, it had been 21 months, in September 2020, when prices last dropped across the board.”

The UK Construction Blog offers a similar, albeit more restrained prediction regarding steel and lumber costs in 2024, highlighting their considerable fluctuation over the previous few years.

“Steel and lumber [prices] have experienced considerable fluctuations in recent years. In 2021, steel prices rose by 77.4%, while timber increased by 80% in the first half of the year. Despite recent trends hinting at a decrease in steel and lumber prices, overall [they] have stayed high.”

Echoing this, Build Partner explain that although materials prices decreased by 2.1% YoY in October 2023, they are still way above pre-pandemic levels, despite the initial demand having subsided.

They argue that there are several factors influencing the prices of construction materials in the UK, including:

- The Cost-of-Doing Business Crisis. As inflation has squeezed the value of the pound, operating costs such as energy prices, wages, interest rates and materials are much higher.

- Brexit. A report in The Guardian states that UK construction costs have risen much more steeply than in the EU. Between 2015 and 2022, the cost of construction materials increased by 60%, whereas they rose only 35% in the EU. The UK is also much more reliant on imports which further increases costs.

- Demand. Build Partner argue that “unless there is something majorly disruptive, such as an innovation that slashes the costs of raw material production, prices of building materials rarely drop back to previous levels following a prolonged increase. If demand sustains after a price increase, suppliers have no reason to reduce their prices – because that’s the price that customers are willing to pay.”

Homebuilding & Renovating Magazine confirms that the cost of building materials declined for the seventh month in a row in February 2024, but this is having little impact on the overall cost of development. Shortages of key materials have meant that new housing development in particular has stalled.

The following products have seen the greatest price fluctuation in the 12 months up to November 2023.

Largest Price Increases

- Pipes and fittings (flexible) +21.1%

- Doors & windows (metal) +18.9%

- Ready-mixed concrete +11.7%

Largest Price Decreases

- Concrete reinforcing bars (steel) -18.2%

- Fabricated structural steel -14.3%

- Imported sawn or planed wood -9.1%

While it’s clear that the cost of building materials should reduce over the coming year, other external factors are likely to keep the costs of property development high. While the top end of the market may be resilient to the cost of living crisis, reduced demand for new housing may impact projects aimed at first-time buyers and young families.

At Hunter Finance, we’ve worked with developers of all sizes across the South East to provide funding for a wide range of successful products. Contact us today to find out more.