We Help Keep Britain Building

Development Finance

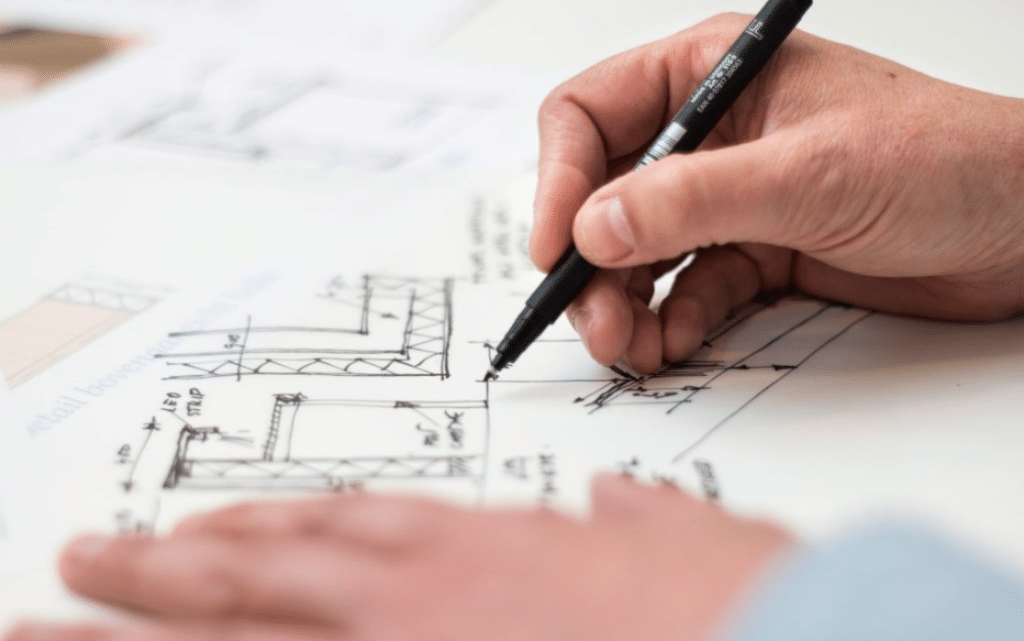

Development Finance is a short-term funding option, usually for between 1-15 months. It is designed to assist with the purchase and build costs associated with a residential development project. This can be a new build, refurbishment or conversion ranging from a single unit through to multiple units built in phases.

The first element of the funding will often be used to assist with the purchase of the development site. This could be land where a number of new properties will be built or an existing property that will undergo a refurbishment / conversion . The second stage of the loan is used to pay for the build costs associated with the project. Funding for the building works will usually be released in drawn down stages, typically once every month.

Over the last 10 years Hunter Finance have lent more than £75,000,000 on over 350 development projects across the South East, helping our clients take action on profitable opportunities and access outstanding returns on their investments.

No hidden costs: 0% brokers fees, zero upfront fees, no initial commitment.

If you are working on a property project or considering a project and are looking for financial support, please contact us.

Lending criteria

We offer residential property loans and residential development finance solutions from £100k - £2.5million. 100% development finance for build costs and up to 60% of land purchase.

Lending Criteria

Lending process

Simple and easy, so you can concentrate on what you do best. As an independent finance provider, we are able to give faster decisions with funding released on the same day as the valuation during the build.

Lending Process

Who we lend to

We specialise in arranging fixed-rate finance facilities for first time and experienced property developers across the South East of England.

How much do we lend?Stop Searching For Finance, Start Building

No Delays

Decisions in 24 hours, every project considered including complex cases.

Loans that cover all costs

Access to 100% development finance for build costs.

One loan

Purchase, build loan and interest rolled up. No monthly repayments.

No hidden costs

0% brokers fees, zero upfront fees, zero initial commitment.

Securing land

LTV land purchase (upto 60% loan to value on acquisition).

Accessible to first-time developers

Exclusive products and competitive fees for first time and inexperienced developers.

Our borrowers

We have provided development finance for first-timers and large property development companies for over a decade. We pride ourselves on offering competitive interest rates and fast professional service to our clients.

- Private individuals or first-timers

- Property companies or SME building companies

- Real estate and commercial developers

At Hunter Finance we are experts in property and finance

- We’ve worked with more than 500 property developers

- We have funded over 800 new build properties

- Our fast finance has helped clients achieve a profit of over £50M

- Provided finance to over 150 first time developers

When we say “Yes” we mean it

- Quick and easy loans: we make the decision to offer loans in less than 48 hours.

- No broker fees: clients save money by dealing with the lender directly. There are no brokers or middlemen slowing down the funding process. You will save thousands in fees, increase your profit at the end of the development

- We have 10+ years of experience: Hunter Finance doesn’t just lend money – our partnership teams are on hand to give you the tools, guides and legal support every step of the way from start to finish of your project. We have a proven track record.

- No upfront application fees

How development funding works

We know that when a good project comes your way, you may need a development financing decision quickly. We are unlike banks and other lenders because as an independent lender, we are able to approve development loans quickly. No committees, board members or bureaucracy getting in the way.

Application

Decision in principle

Surveyor instruction

Legal instruction

Agreement & Funding

How is the loan repaid?

All Fees including interest are rolled into the loan and repaid in one sum upon sale or Refinance of the development. If the project has phased sales or refinancing with numerous units, we would simply take an agreed % from each sale to maintain our loan to value %.

How could equity financing work for you?

We also offer equity financing as an alternative property development finance option. With equity finance, we provide the finance you need in exchange for a share of the property development’s profit. Equity funding is a straight forward way to raise finance and benefit from our expertise in the industry.

What Our Developers Have To Say

Want to find out more about what our clients have to say about us?