Property Development Finance in Essex

Essex

Essex offers an exciting landscape for property developers looking for their next project. It’s got a healthy mix of vibrant towns and cities, charming villages, coastal communities, greenbelt land, and excellent commuter access to London. Along with the other Home Counties, it’s a property hotspot in the South East.

Featuring historic market towns like Saffron Walden and Maldon, dynamic urban centres such as Chelmsford and Colchester, coastal conurbations like Southend and Clacton-on-Sea, and of course the eastern fringes of London itself, Essex caters to a wide range of lifestyles and demographics.

Its excellent transport links to London include the Elizabeth Line through Brentwood and Shenfield, fast Greater Anglia services from Chelmsford and Colchester, as well as C2C services to Southend. This makes Essex a magnet for professionals and younger families looking for more space without sacrificing convenience.

With over a decade of experience in funding property developments across the South East, we understand the Essex market and can help you secure the finance you need to make your next project a success.

Understanding Property Development in Essex

Essex is governed by several districts and unitary authorities, including Chelmsford City Council, Colchester Borough Council, and Southend and Thurrock unitary authorities. Each has a Local Plan that sets out strategic housing targets, land allocations, and environmental protections to consider.

Property development in Essex is subject to the same laws and regulations as many other parts of the UK, but local planning laws and frameworks will still apply, especially in and around the various coastal nature reserves like Blackwater Estuary, Hamford Water, Wrabness and more.

Similarly, Essex has a significant amount of greenbelt land around Epping Forest, Brentwood and Uttlesford, which is subject to stricter planning laws. Although there are proposals to allow more building on the greenbelt, development here is still generally only permitted under certain circumstances, so be prepared to demonstrate the necessity and benefit of any proposed build.

Biodiversity Net Gain is mandatory across England, and therefore, any new developments in Essex must demonstrate a 10% net gain in biodiversity. This is particularly relevant across rural and coastal areas, where developments are more likely to impact native species and habitats.

As with many other areas, protected species such as great crested newts, water voles, or bats can be found in Essex. You’ll need an ecological survey and potentially a mitigation plan from Natural England before construction can proceed.

Lastly, most Essex councils have adopted a Community Infrastructure Levy (CIL) or use Section 106 agreements that mean some developers may have to contribute towards infrastructure such as schools, healthcare and transport. However, rates can vary dramatically between councils, so it’s important to check and factor this into any development finance application.

The Essex Property Market

Essex continues to be a high-performing region in terms of demand and long-term growth potential. While prices in affluent areas can rival outer London, there are excellent opportunities for ambitious developers in towns undergoing regeneration, such as Harlow, Basildon and Colchester.

Demand varies across the region, but 3- and 4-bedroom homes are always popular in areas with good schools, green space and easy London links such as Southend, Chelmsford and Billericay. Housing suitable for first-time buyers is also very popular, especially for those priced out of London.

In more affluent and rural areas, we also see demand for low-carbon, eco and energy-efficient homes that incorporate solar panels, heat pumps, EV chargers and excellent insulation.

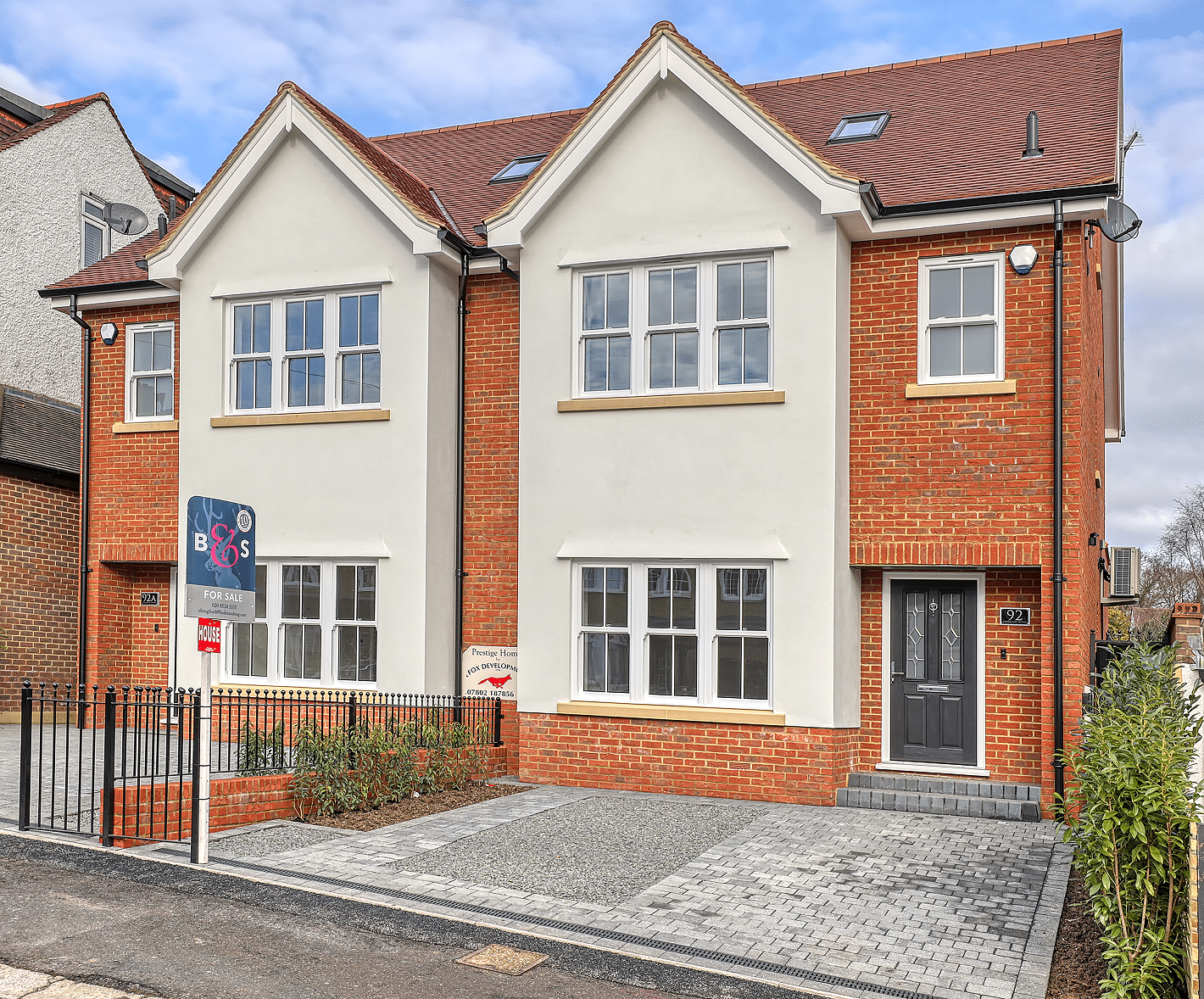

Property Developments We Have Financed in Essex

We’ve successfully financed a range of property development projects in Essex including flats, apartments, terraced houses and large detached family homes.

- New Build Semi-detached houses in Chingford – £600k Loan

- New Build Detached Homes in Shadoxhurst – £750k Loan

- 2 Semi-detached properties in Steeple Morden, Cambridgeshire – £300k Loan

- Bungalow Conversion in Ware, Hertfordshire – £250k Loan

- New Builds in Challock – £985k Loan

Why choose an independent broker near Essex?

We are unlike banks in that we lend our own funds as independent lenders. Based in Sussex, we have a huge amount of experience in property development projects in the South East of England, meaning we can offer relevant help and advice right at the moment you need it. Not only is our development finance quicker and cheaper than banks, we are also a supportive ear who understands the challenges of the local market.

Types of Property Development Finance in Essex

Development Finance

Development finance for private residential property developments in the South East UK.

Equity Finance

Equity finance for property developers in return for a share of the development’s profit.

Bridging Loans

Bridging loans for developers to provide short-term finance to ‘bridge the gap in projects.

Pre-completion Loans

Pre-completion finance loans for property developments that are very close to completion.

Exit Finance

Exit finance is used to repay outstanding development finance so that it's ready for sale.

What Our Developers Have To Say

Want to find out more about what our clients have to say about us?