Key Points

- The south east, and Kent in particular, are property development hotspots in 2025.

- Family-sized homes are proving to be the most desirable.

- Government legislation is opening up potential land for development.

- The south east is outperforming the national average in the property market.

We know the last few years have been tough on the property development market. Although house prices and demand have remained high, increases in land and materials costs, as well as the huge increase in mortgage rates, have created an uncertain environment.

But what about us down here in the south east? Alongside London, we’ve always been one of the most resilient and reliable property markets in the UK. And 2025 is proving to be no different.

We’ve dug through the data to get to the facts and outline why the south east remains an attractive and reliable property development market. Let’s take a look.

Consistent & Above Average House Price Growth

The UK’s House Price Index for March 2025 (published in May 2025) showed that the south east experienced an average 5.3% YoY increase in house prices, up 0.7% from February 2025, meaning the average house price was £386,000.

By comparison, London experienced a growth of just 0.8% YoY for the same period. As people continue to be priced out of the capital, or look for a quieter life with more space, they seem to be stimulating demand in Kent, Surrey, Sussex and Hampshire.

For property developers, projects for family homes in commuter-friendly areas seem to be as reliable as ever. What’s more, it seems like people are buying. Even taking seasonal patterns into account, demand is largely being sustained, with the average time to sell reducing to 66 days, down from 75 at the start of the year.

In the south east, Canterbury seems to be the best-performing area, both in terms of pricing and demand.

Interest Rates Are Down

Interest rates were cut for a fourth time to 4.25% (from 4.5%) in May by the Bank of England, which is welcome news for both buyers and sellers. Although the market remains volatile, with US tariffs and the situation in the Middle East impacting the global economy, there is a reasonable expectation that interest rates may drop to 3.75% by the end of 2025.

Low interest rates are already making their way through to mortgages, with the average two-year fixed mortgage rate now fallen to its lowest level since September 2022. If the trend keeps going, this could make mortgages even more affordable and stimulate demand in the south east.

Stamp Duty Increases Had Minimal Impacts

It was predicted that property sales in the south east would surge due to the end of Stamp Duty relief in April 2025, and they did, but the expected dip in demand in the following weeks and months hasn’t materialised.

Rightmove “haven’t seen an increase in the number of home sales falling through, which indicates there hasn’t been any major backtracking from first-time buyers and movers who were unable to complete before the tax rise. There was also a late rush to complete sales from those who had agreed on their sales in time to beat the stamp duty deadline.”

Likewise, Morgan & Associates reported that housing market activity in the south east regained momentum, and agreed sales in May reached a four-year high. However, this demand is tempered due to a 13% YoY increase in the number of homes for sale.

For property developers, this means buyers have a wider selection, and you’ll need to carefully consider and plan your project to ensure it meets the requirements of your target buyers.

The New Build Premium

Data from Halifax confirms that new builds in the South East carry a significant premium, something that should be music to developers’ ears.

In early 2025, new-build properties in the UK had an average price of £314,587, representing a £33,514 premium compared to existing homes. According to Plumplot, the average price of an existing home in the south east in April 2025 was £441,000 compared to £467,000 for new builds.

This indicates that buyers are willing to pay significantly more for newly constructed properties. The premium for new builds can also vary between types, with flats potentially commanding even higher premiums. For example, buyers of flats might pay up to £71,865 more for a new build.

New Builds Make a Tiny Percentage of Available Homes

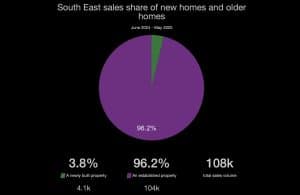

Despite a preference for and a premium on new build homes, they made up just 3.4% of the 108,000 property sales that occurred in the south east between April 2024 and May 2025.

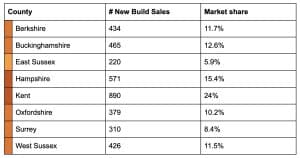

Broken down by county in the same period, we can see below that East Sussex and Surrey had the least market share of new build sales, whereas Kent and Hampshire dominate the market.

- Berkshire: 434 Sales (11.7% of total)

- Buckinghamshire: 465 (12.6%)

- East Sussex: 220 (5.9%)

- Hampshire: 571 (15.4%)

- Kent: 890 (24%)

- Oxfordshire: 379 (10.2%)

- Surrey: 310 (8.4%)

- West Sussex: 426 (11.5%)

Family Homes Dominate New Build Sales

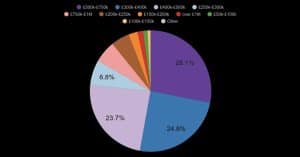

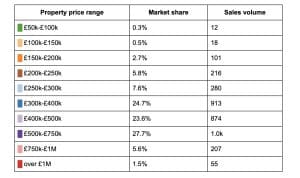

During May 2024 and April 2025, new build homes designed for families seemed to dominate the market.

- Under £50k: 23 Total Sales (0.0%)

- £50k-£100k: 1.3k (1.2%)

- £100k-£150k: 3.3k (3.1%)

- £150k-£200k: 6.8k (6.3%)

- £200k-£250k: 9.9k (9.2%)

- £250k-£300k: 13.3k (12.3%)

- £300k-£400k: 26.5k (24.6%)

- £400k-£500k: 18.0k (16.7%)

- £500k-£750k: 18.9k (17.5%)

- £750k-£1M: 6.1k (5.7%)

- over £1M: 3.9k (3.6%)

Clearly, family-sized homes in Kent seem to be both highly desirable and selling well. However, perhaps East & West Sussex, and Surrey represent a fantastic opportunity for developers.

A Burgeoning Local Authority Development Push

In Kent, major property development schemes such as Ebbsfleet Garden City are making progress, with thousands of new homes either completed, under construction, or recently approved. Similar projects are also proposed across Sussex, Hampshire and the rest of the south east.

Projects like this reflect sustained local authority commitment to housing delivery targets and represent an opportunity for developers of all sizes to capitalise on the government’s drive to build new homes. Should proposed changes to green, brown and grey-belt legislation go through, many more potential plots of land may become viable options.

Securing Property Development Finance in The South East

The south east remains a property developer’s playground, with plenty of demand and increasingly more opportunities opening up. If you’ve identified your next project and are evaluating your finance options, we’re always eager to speak to developers of all sizes.

Contact us today to find out more about out property development finance options, and bring your project to life.